The Typical Home Inspection Claim Runaround

I’ve now been successfully defending home inspectors against meritless claims for a decade now, and with over 1,000 claims under my belt, I feel I’m qualified to describe the typical home inspection claim runaround competent home inspectors like yourself receive when dealing with an “issue” that really isn’t your “issue” at all.

I’ve now been successfully defending home inspectors against meritless claims for a decade now, and with over 1,000 claims under my belt, I feel I’m qualified to describe the typical home inspection claim runaround competent home inspectors like yourself receive when dealing with an “issue” that really isn’t your “issue” at all.

I recently received a phone call from an inspector who was STILL dealing with an issue after two-plus years. The attorney representing him had, not surprisingly, been running up massive legal fees in the six figures without even the slightest desire to terminate the case. Why would he? His interests lied in his own billable hours driving fees as high as possible.

(more…)

I’m starting to see a very disturbing trend developing between the home inspection industry and the real estate marketplace: non-client home sellers are bringing claims against home inspectors for the failure of their clients to follow through on the agreement of sale as a consequence of the home inspector’s findings.

I’m starting to see a very disturbing trend developing between the home inspection industry and the real estate marketplace: non-client home sellers are bringing claims against home inspectors for the failure of their clients to follow through on the agreement of sale as a consequence of the home inspector’s findings. In the discovery phase of a lawsuit, laywers ask witnesses questions under oath that are recorded by a court reporter. Believe it or not, lying is commonplace!

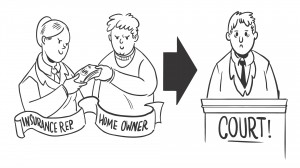

In the discovery phase of a lawsuit, laywers ask witnesses questions under oath that are recorded by a court reporter. Believe it or not, lying is commonplace! A claim is brought against you after inspecting a vacant house, and your insurance company wants you to (surprise, surprise) settle it quickly and claim responsibility. However, you didn’t do anything wrong and instead want to fight the claim, but you are afraid your insurance company will bail if you don’t agree to settle.

A claim is brought against you after inspecting a vacant house, and your insurance company wants you to (surprise, surprise) settle it quickly and claim responsibility. However, you didn’t do anything wrong and instead want to fight the claim, but you are afraid your insurance company will bail if you don’t agree to settle. Insurance companies will sometimes pay a claim to a homeowner and THEN try to recover the financial losses from the home inspector through a process called subrogation.

Insurance companies will sometimes pay a claim to a homeowner and THEN try to recover the financial losses from the home inspector through a process called subrogation. I remember the advice I received from a savvy real estate investor as I was about to purchase my first house.

I remember the advice I received from a savvy real estate investor as I was about to purchase my first house.